I think quite arguably it was both. In order to put things in a bit of perspective, let me paint the picture for you how we experienced it at Leading Edge.

January and February are typically slower months in this industry for aircraft transactions and 2020 was no exception. We all know what then happened in mid-March.

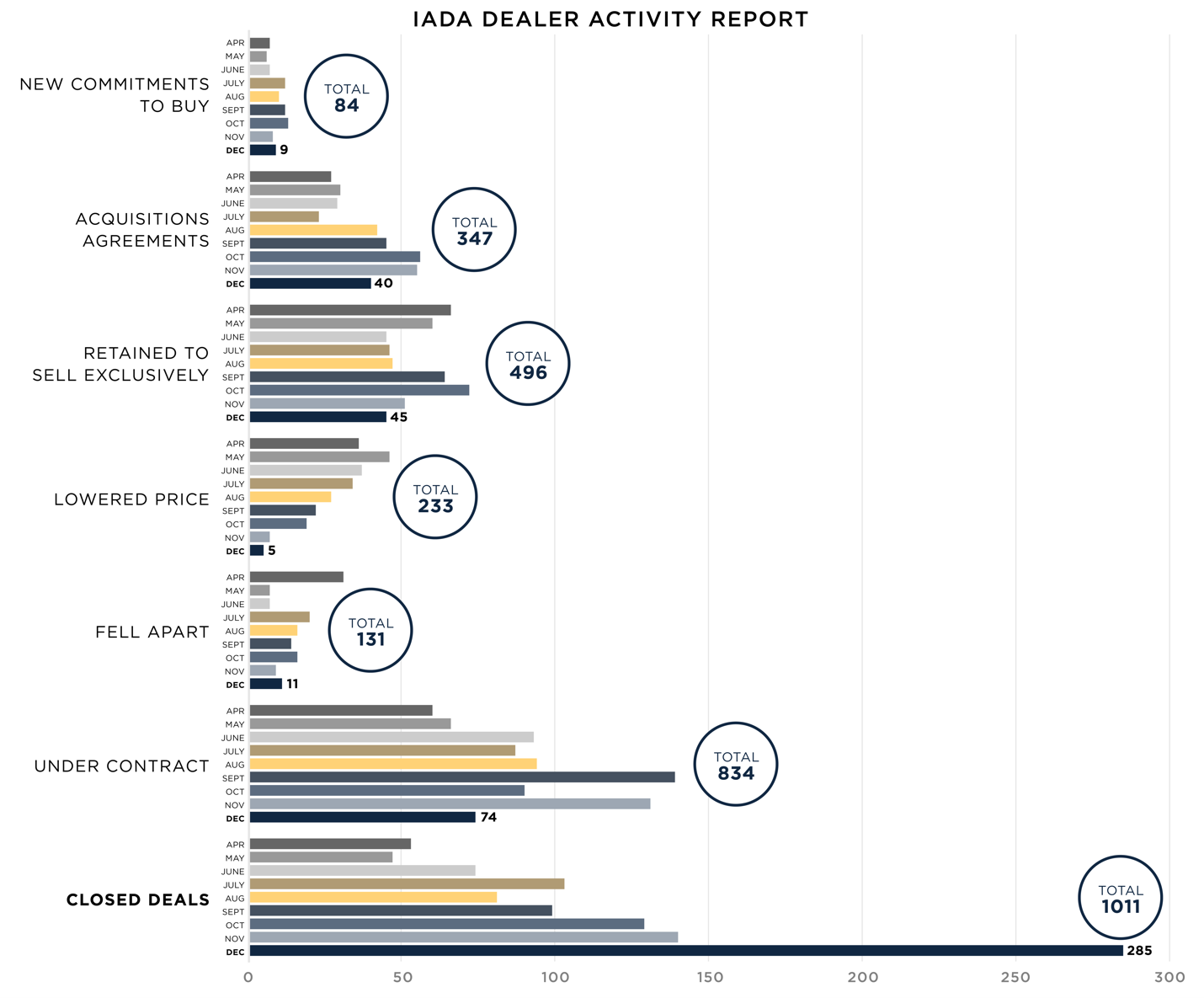

When I was sitting in my home office at the end of March as the new IADA Board Chairman, some of us within IADA decided to create a series of questions to ask the members monthly. This began in April. It was an exercise in taking the pulse of our industry and trying to read if the bottom was going to fall out of it. It was an exercise in survival. It was surreal seeing the data that came in during April and May. Prices were falling rapidly and people were getting sick everywhere here in the northeast, especially where we are located just outside of New York City.

We have enjoyed steady success for many years averaging approximately thirty aircraft transactions per year for the last several years. As of June 30th we had closed a grand total of five.

But then things began to turn as the summer started to press on. As my IADA associates reported their sales volume and how many new engagements they had entered to purchase aircraft for clients, I could smell things were beginning to transform. By the time it was the fourth quarter, the market was as hot as I have ever seen it. We finished up with 30 transactions completed and had a year very similar to 2019 – but here is the eyebrow raiser. We transacted as many aircraft in the fourth quarter as we did in the first three quarters combined.

What did this? And will it continue in 2021? Here is what I think contributed to it in order of magnitude:

- Prices dropped quickly to the tune of between 5% for light aircraft and 20% for large aircraft. So non-corporate buyers began swooping in and buying up the attractive deals.

- A new cache of buyers entered the market. These were people who considered purchasing an aircraft and were primarily charter clients or fractional owners. This added to the demand.

- And the icing on the cake, what caused November and December to just go off the charts (literally), was the fear that the favorable tax law that was on the books would disappear. This tax law allowed 100% depreciation in year one for those whose use qualified for it. Many were afraid the rules would change in 2021 if the administration changed. After November 4th, this became a very big driver.

But, What Does the

Future Hold?

For 2021, our read at LEAS is as follows:

- Wealthy individuals will still not want to get on the airlines, so there will continue to be some first time buyers that enter this space.

- If the Biden administration begins discussion about repealing the Trump Tax Bill that passed in late 2017, it will put shivers into the market. However, we believe will be short lived. The question is whether the change will be retroactive to January 1, 2021 or will it take effect January 1, 2022. If it’s the former, expect the shivers short term. If it’s the latter, the market will continue to be strong all year. We just will not know until discussions about the tax bill comes to the forefront. When they do, no matter what, the court of public opinion never feels sorry for the private jet owner.

- Once vaccines are widespread mid-year, we believe corporate travelers will begin to fly again in greater numbers.

- Wealthy individuals and privately held companies will begin to need to fly again for business use.

- The airlines will, for the short term, completely underserve this demand.

Put all of this together and we are of the thinking that 2021 will hang in there and be ok because of the real demand that exists for the products and services we offer.

Leading Edge by The Numbers

With 895 transactions completed since 1989, here is a look at our 2020:

13 Gulfstream, 5 Citations, 4 Challengers, 2 Turbo Props,

2 Falcons, 1 Global, 1 Falcon, 1 Nextant and 1 Phenom 100.

Thank you to all of our clients and associates that helped LEAS have a successful 2020. It started as the year of the tortoise but sure finished as the year of the hare.

Written By:

Joseph Carfagna, Jr.

President, Leading Edge Aviation Solutions