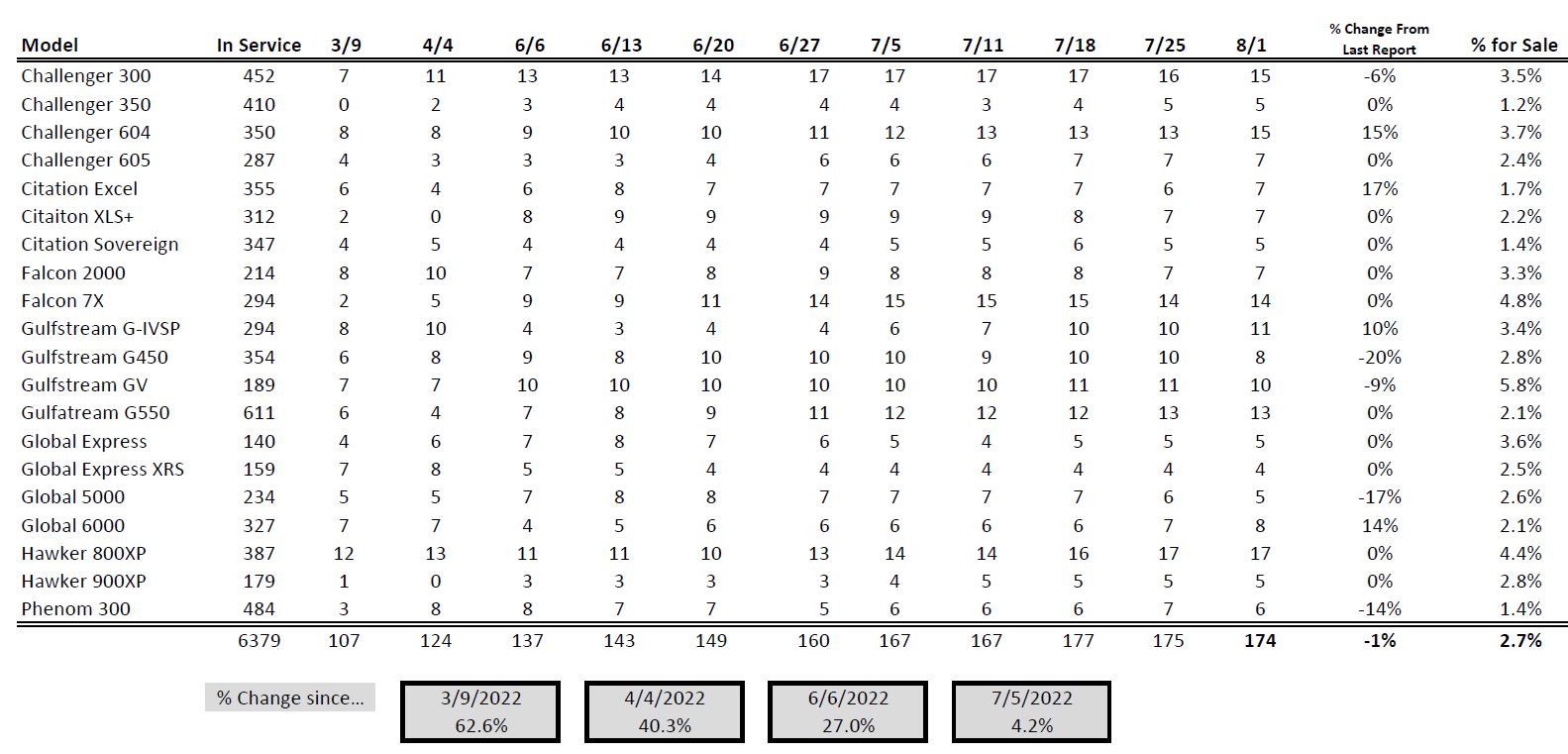

It was clear to all of us in the industry that supply of virtually all types of corporate aircraft were running very low in late 2021 and into early 2022. When it felt like the scarcity could not get more acute, we began tracking things very closely and our in-house market analysts went to work to measure things. On March 9th, 2022 we began tracking 18 of the most commonly traded business jets from light jets to ultra heavy long range jets and many in between. Take a look at the chart below – on March 9th across the 18 types of aircraft there were only 107 units for sale. We must have timed the low point just about right to begin studying this closely.

As the weeks passed by into spring and now summer, we can see a steady increase week by week in available inventory – nearly 64% since March 9th in fact. Aircraft like the Falcon 7X that had 2 available now have 14, Gulfstream G550 inventory more than doubled from 6 to 13, and Challenger 300’s from 7 to 16. Again we ask ourselves: why? In order of magnitude we see it as follows: 1) sellers are realizing now is a good time to sell while the market is still hot and they are still getting close to top dollar for their aircraft: 2) demand, although still strong, is not “white hot” as it was with multiple bidding wars occurring for most listings; and 3) there simply is more uncertainty in the world since February and early March between a war, a bear stock market, rising interest rates, a strong increase in fuel prices and endless talk about a recession, which essentially are the reasons for #2 above.

Let’s not lose sight of the big picture, however. Our industry’s “normal” range of the fleet for sale is typically 8% to 10%. We have recent changes that have moved supply from approximately 1.5% of the fleet for sale to 3%. This still represents inadequate supply historically. The shift from March 9th to the present seems very large when things have moved from near zero to “some” but it’s still a tight market.

Two weeks ago, we saw the numbers “normalize”, level off and stop growing. This past week was the second week we saw this trend, with overall only one new net aircraft added to the market. Is this just an anomaly? In another few weeks we can hopefully answer the question of whether it’s the beginning of a trend or not. Year end buyers driven by the end of 100% bonus depreciation either have started or soon will start entering the fray. Remember that 100% bonus depreciation expires 12/31/22 and goes down to 80% for 2023. 80% is still very good, but it is not 100%.

What does all of this mean for you? For investors, dollar cost averaging is the way to avoid the necessity of timing the market just right. For an aircraft buyer, to time things right you must stay very well informed and perhaps ready to make a decision in a timely manner, so a purchase fits your needs relative to timing, your tax requirements and the market. While inventory has been increasing slowly, transactions are still happening quickly. The aircraft that you saw come to market today may not be available two days from now and you’d rather buy the $11M aircraft for $10M, not the $10M for $11M. Having a trusted broker monitoring the markets you are interested in, and alerting you to off-market opportunities, may be the difference between finding your perfect aircraft or settling for one because it’s the only one available on this side of the planet.

For a seller, trust that your broker will bring you real offers from qualified buyers. You can also trust that your broker will know what deal will be in your best interest. There is still high demand for good pedigree aircraft from turbo props to large jets. If you have ever considered selling your aircraft, now is the time to capitalize on this increased demand while it is still as strong as we have seen it in years. We do not know how long this current climate is going to last as it is changing week over week, but there are still plenty of buyers willing to pay a premium for the right aircraft.

A broker will serve as your negotiator, advocate, and fiduciary; making something complex become very simple for you as the client. With over 900 transactions under our belt, Leading Edge has seen it all. Whether you are looking to buy or sell, we pride ourselves with offering what we believe to be the best insight available within the aircraft brokerage community to help you from start to finish.